Behöver du hjälp?

Vi vill gärna hjälpa dig!

Välj nedan vilket kontaktsätt som passar dig bäst.

Vi vill gärna hjälpa dig!

Välj nedan vilket kontaktsätt som passar dig bäst.

Consumers have seemingly always been prepared to travel long distances to shop. As e-commerce continues to advance, large shopping centres risk finding it tougher and tougher to attract couch loving consumers who would rather order goods for home delivery by computer click than getting into their car.

Over the last twenty years, bricks and mortar retailing has enjoyed unbroken positive growth. Shopping centres in larger towns in particular have contributed to this. Clusters have developed that have created strong people flows, not just within municipalities themselves but also from smaller surrounding municipalities from which people often come by car to shop. Retailing in Sweden has accordingly very largely become concentrated to larger municipalities when people have increasingly chosen to travel long distances to buy a new sofa or TV.

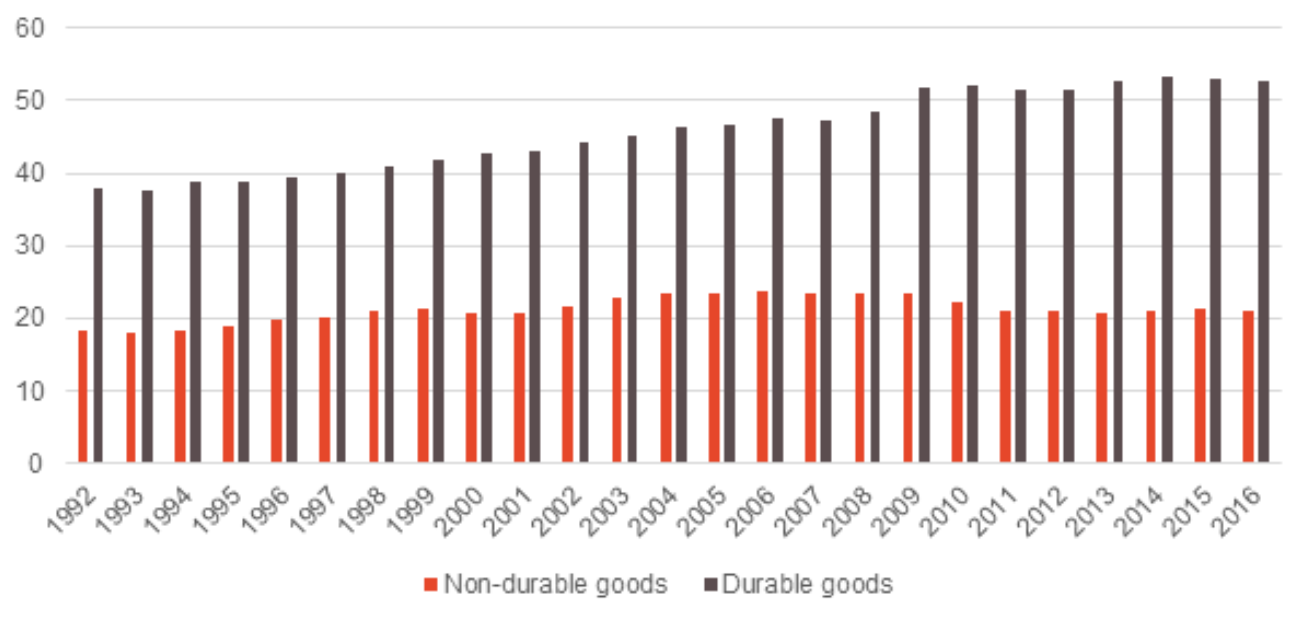

The pulling power of strong retail destinations and the increased mobility across municipal borders by local residents are confirmed by the HUI database Handeln i Sverige (Retail in Sweden) that tracks retailing at regional level. Generally speaking, consumer durables retailing is far more concentrated than food and FMCG retailing (non-durable goods). This means that sales of everyday products are more evenly distributed around Swedish municipalities than sales of durable goods, and in turn, reflects the behaviour of people who are usually prepared to travel further to buy durable goods such as furniture and electronics than for groceries. Up to the mid 2000s, these two sectors have followed suit in terms of concentration. The differences have since become more pronounced, very large due to growth in larger municipalities. It would appear, then, that municipalities that already had strong pulling power in that period have since also become even more dominant on their local market.

Figure 1 – Difference in sales index in Swedish municipalities from 1992-2016

Source: Handeln i Sverige HUI Research (Retail in Sweden)

Between the mid 2000s and today, however, the pattern has changed. While durable goods retailing has continued to become more concentrated, which has often meant smaller traders in smaller municipalities have struggled to stay afloat, the concentration of FMCG retailing has shown a declining trend over the past decade instead. An underlying explanation is that competition within FMCG retailing has increased in small and medium sized municipalities, often in the form of low price retailers, that have contributed to increased sales and in so doing, slowed the outflow of consumers to larger towns.

As such, retail concentrationhas never been as pronounced as it is today. Consumer durable goods retailing has continued to become concentrated in larger towns in a region with strong shopping centres, while at the same time, the concentration of FMCG retailing has declined and reduced in line with the establishment of new stores in smaller municipalities. It will therefore be particularly interesting to monitor the forward march of digital commerce and how this will affect people flows in the longer term. Will consumers continue to travel all the way to a neighbouring municipality to buy a new TV, or will they order one online instead for home delivery?

This report has been produced by Storesupport and HUI Research.