Behöver du hjälp?

Vi vill gärna hjälpa dig!

Välj nedan vilket kontaktsätt som passar dig bäst.

Vi vill gärna hjälpa dig!

Välj nedan vilket kontaktsätt som passar dig bäst.

More and more purchases are being made online – at the expense of bricks and mortar retailing

Online stores are rapidly gaining ground on bricks and mortar stores. Not only are sales growing at a far faster rate online than in bricks and mortar stores, but there is also a significant change in the behaviour pattern of where consumers made their most recent physical store purchase. This is according to the E-barometer Annual Report for 2016 published by HUI Research in cooperation with Postnord and Svensk Digital handel.

This time last year, just over one in five consumers made their latest purchase in an online store – now that figure is one in three. All types of bricks and mortar stores are losing ground to etailing. Stores in town centres, supermarkets and shopping malls have all seen customers switch their purchasing to the internet. It is primarily those consumers that shop online regularly, more than once a month, who seem to be now making more and more of their purchases online. Etailing has accordingly managed to create a strong sense of loyalty amongst their customers. Once a customer has started buying online, it is highly likely that they will continue to do so. Customers have matured and feel they can trust what they will be getting when they order online in terms of both product quality and delivery service.

Growth in Swedish etailing is taking off like a jet aircraft. Swedish etailers had sales of SEK 57.9 billion in 2016, which means they now account for 7.7 percent of total retail sales. The food and construction industries are the strongest performers with growth of 30 and 29 percent respectively. Both these sectors are in a vigorous growth phase. Within food retailing, it is primarily online shopping where consumers load their trolley themselves, that is dominating growth. Growth of the previously popular food boxes that were a good entry port to online grocery shopping for many people has now more or less come to a halt. The sector has also made advances in logistics, a crucial element for etailing. To a far greater extent than other sectors, food shoppers online are able to book home delivery for a time that suits them plus same day delivery. These factors are absolutely crucial in many ways in successfully realigning the ingrained consumer behaviour pattern of jumping in a car and driving to a bricks and mortar supermarket to do their food shop.

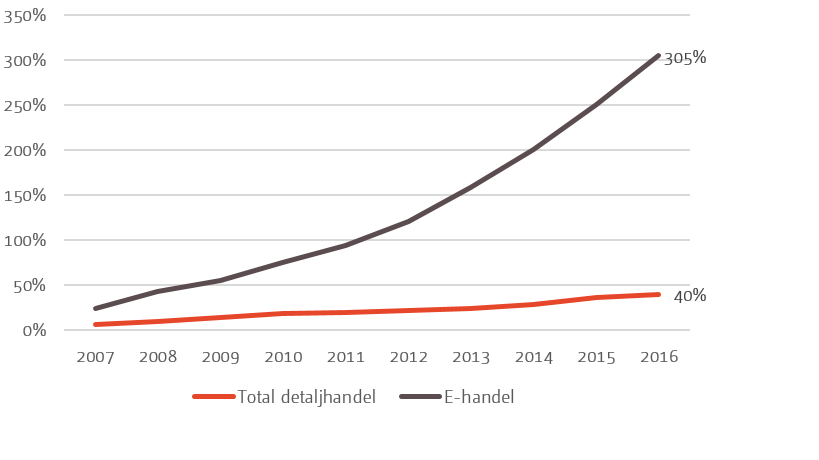

Graph. Growth for total retailing and etailing respectively in Sweden over the past 10 years (all percentages are in comparison with 2006)

Two in three Swedes did online shopping per month in 2016 and one in five Swedish consumers made an international online purchase. International commerce is very seasonally based with summer peaks in early May and June when many consumers refresh their wardrobe via orders from large fashion retailers in e.g. Britain and Germany. This is a significant challenge for Swedish etailers that need to find more ways of broadening their ranges and maintaining attractive prices to persuade consumers to continue to buy Swedish.

Smartphones have quickly become the most talked about purchasing channel. Naturally, consumers make purchases via their smartphones, but are also increasingly using them to do research both at home and when they are actually out shopping. Over a one-month period, one in five Swedes searched for product information when they were in a bricks and mortar store and one in four checked the stock balance on their phone before going to a store. This is a clear illustration of the importance to bricks and mortar retailers of having a well-developed concept for purchasing in several different channels. All the signs suggest that customers are becoming increasingly well-informed before making a purchase. A consistent concept in both physical and digital channels enables both retailers and consumers to be in control of the purchasing process. For retailers, control comes in the form of the information provided to customers and increasing the number of opportunities to persuade the customer to choose their store in particular. For consumers, being in control gives them greater assurance that they will be satisfied with their purchase. A win-win situation that often results in the consumer ultimately spending more. In the fourth quarter of 2016, multi-channel consumers purchased just over 10 percent more than single channel consumers. Consumers who did some research before deciding what to buy spend over 60 percent more than more spontaneous consumers.