Behöver du hjälp?

Vi vill gärna hjälpa dig!

Välj nedan vilket kontaktsätt som passar dig bäst.

Vi vill gärna hjälpa dig!

Välj nedan vilket kontaktsätt som passar dig bäst.

Some 90 percent of the Swedish population lived in rural areas 200 years ago. Today, around 85 percent live in an urban environment and this proportion continues to grow, which makes Sweden one of the most urbanised countries in the world. Which means the importance of cities as places where we live, work, shop and socialise becomes ever greater. And as cities become more and more like a second living room, the relationship between various city functions is also changing. Hotels, restaurants and services take more space while retailers are retreating.

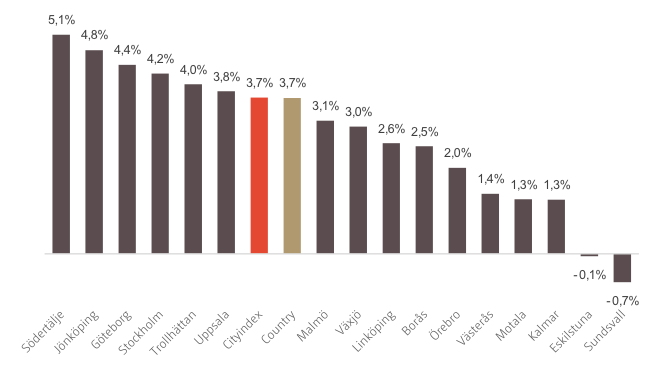

HUI has been commissioned by Agora to survey 16 Swedish city centres. The majority of these enjoyed relatively good growth in the 2015-2016 period and in line with the aggregate growth of 3.7 percent in the country as a whole, with regard to retailing, restaurants, hotels and commercial services. Södertälje enjoyed the strongest growth, followed by Jönköping. Eskilstuna and Sundsvall were the city centres with the weakest growth and recorded negative growth statistics.

In terms of turnover, retailing is the dominant sector in the city centres surveyed. The structure of city centres differs pretty significantly from the national pattern, however. Just over 40 percent of total retail sales consist of fast moving consumer goods, compared to 22 percent in city centres. Clothing and shoes has a far stronger position with almost 30 percent of turnover generated in this segment. The market share of Home and Leisure, that covers all consumer durables other than clothing and shoes, is similar in city centres to the national average.

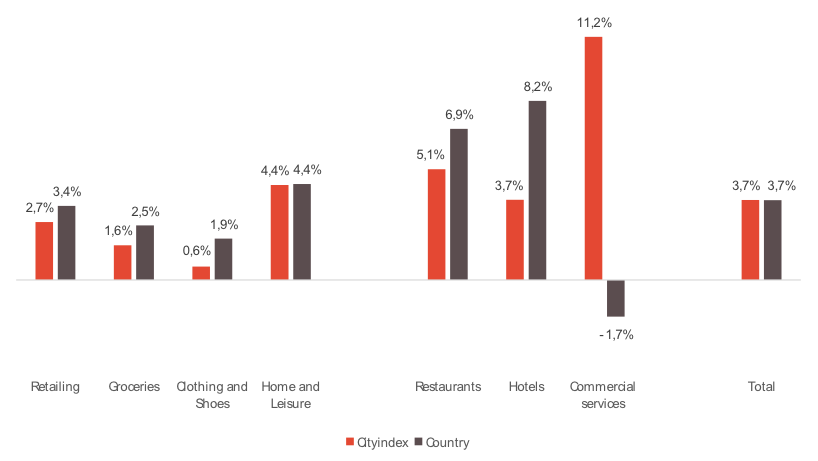

Based on the above, particular attention ought to be given to developments in the clothing and shoes segment when taking a closer look at city centre retailing. The year’s winner when it comes to commerce in city centres is commercial services, such as fitness centres, cinemas and hairdressers, in terms of percentages and by the Home and Leisure segment in terms of kronor and cents. The restaurant sector, the second largest sector by turnover after retailing, reported good growth of over 5 percent. The retailing sector as a whole reported growth of 2.7 percent. Clothes retailing had the lowest growth with 0.6 percent. Clothing and shoes is a very competitive segment where city centres are competing with out of town shopping malls and fast growing e-tailing.

When growth is summarised, it is clear that city centres are maintaining the same rate of growth as the country as a whole, but that retailing in city centres is lagging behind. Total retailing growth is primarily being driven by e-tailing and shopping malls that enjoyed growth of 16 and 5 percent respectively in 2016. Although city centres will find it difficult to maintain the same tempo as these sales channels, primarily when it comes to retailing, they have greater potential within the other sectors. As such, we will probably see an ever expanding choice of restaurants, commercial services and hotels in Swedish cities, while retailing will take a step backwards at the same time.

In autumn 2016, HUI Research was commissioned by Agora (A Group of Retail Assets Sweden AB) to supply the market with an objective survey of city centres, in consultation with Cityindex. The initial survey covered Stockholm, Gothenburg, Malmö and 13 other cities, but the intention is to make the survey nationwide by including all 124 cities in Sweden. Cityindex primarily addressed developments within retailing, but the survey also covers the restaurant industry, hotels and commercial service providers within the respective city centres. What makes the survey unique is that both cities and city centres were defined in consultation with researchers, retailers, property companies, sector organisations and other bodies.