Behöver du hjälp?

Vi vill gärna hjälpa dig!

Välj nedan vilket kontaktsätt som passar dig bäst.

Vi vill gärna hjälpa dig!

Välj nedan vilket kontaktsätt som passar dig bäst.

The Christmas month of December has long been a time of shopping fever. Year after year, Christmas shopping breaks new sales records, not least thanks to population growth and increases in real wages. For this December, HUI forecasts that retail sales will increase by 3 percent compared to the same month last year, broken down into 3.5 percent for consumer durable goods and 2.5 percent for FMCG. In 2017, the majority of growth in durable goods retailing has been within e-commerce and the Christmas period will probably be no exception.

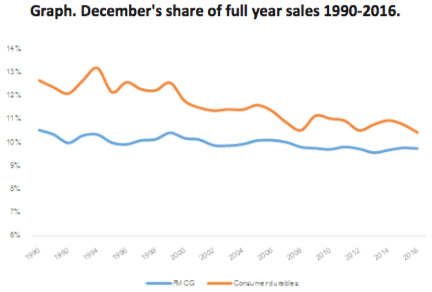

Viewed over the last 25 years, however, one very interesting sales phenomenon has arisen with regard to Christmas shopping and December. Within durable goods retail, there has been a clear trend for December to become less significant compared to the rest of the year. December last year reported the lowest sales in modern retail history with 10.4 percent of sales for the year being made that month.

There are several explanations for this downward trend in durable goods retailing, that are closely connected and complex. Firstly, household economies have become better and better, which has enabled them to spread their consumption over the whole year. This differs from earlier periods when many Swedes saved through the year to have a good Christmas with plenty of presents. Secondly, sub sectors that are not traditional Christmas sectors, such as building supplies and furniture retailing, have grown much stronger in this period. These are capital intensive sectors where sales fall off completely in other months of the year and so contribute to durable goods sales becoming spread across the year.

The third explanation is perhaps the most fascinating and all the rage. Historically, low figures for December have coincided with major financial crises such as in 2008, not long before the start of the Christmas shopping period and households drew their horns in. However, in the last few years, December sales have continued to fall even though Sweden has enjoyed very good economic growth. This is probably very closely connected with the explosive growth of Black Friday shopping, that in many cases has expanded to become Black Week. This short, reduced price period seems to have impacted the breakdown of retail purchases between November and December. Probably to the anguish of many retailers, as Christmas purchases with full margins have been replaced by campaign purchases under strong price pressure, which leads to profitability on a fiercely competitive market being further nibbled away at the edges. Having said that, a well-prepared retailer can surely use Black Friday to drive up volumes based on a campaign adapted business model and so retain acceptable margins and claim a higher share of November wallets in Sweden.

In the case of FMCG, for its part, December has remained relevant as a strong retailing month in relation to the rest of the months of the year. Around 10 percent of FMCG sales for the year are made in December. In addition to the more traditional shopping for Christmas food, food retailers are proficient in reminding consumers about characteristic food, cakes and puddings etc., over the Christmas period, which keeps sales up. This is not least the case with online based parties that have been marketing themselves for several weeks via newsletters and print ads to help consumers remember to stock up with Christmas drinks, cakes, pies, puddings and for parties. Another example are smaller online based entrepreneurs that offer organic meat straight from the farm to your front door. Yet another Christmas example is food hamper companies and traditional food purveyors that offer Christmas and New Year hampers including everything you need for your Christmas dinner or New Year’s Eve party.

With these thoughts and reflections, Storesupport and HUI Research would like to wish all readers a really Merry Christmas.

This report has been developed in cooperation with Storesupport and HUI Research.